Understanding Flexible Spending Accounts (FSAs)

FSAs are employer-sponsored accounts letting you set aside pre-tax income for eligible healthcare expenses. This offers tax advantages, reducing your taxable income and lowering your overall tax burden. Many employers offer FSAs as part of their benefits packages;

What is an FSA?

A Flexible Spending Account (FSA) is a pre-tax savings account offered by many employers. Employees contribute a portion of their pre-tax salary, which is then used to pay for eligible healthcare expenses. The money is not taxed, resulting in significant savings. There are several types of FSAs, including health FSAs, limited purpose FSAs (for dental and vision care only), and dependent care FSAs (for childcare costs). FSAs are a valuable tool for managing healthcare expenses, allowing individuals to pay for a wide range of items and services with pre-tax dollars. The amount you can contribute to an FSA is usually limited annually, and any unused funds at the end of the year are typically forfeited. Understanding the rules and regulations surrounding your FSA is crucial to maximizing its benefits.

FSA Eligibility and Tax Advantages

Eligibility for an FSA is typically determined by your employer. Most employers offering FSAs require enrollment during an open enrollment period, usually annually. To be eligible, you generally must be an employee of the company offering the plan and be actively working; The significant tax advantage of an FSA lies in the pre-tax contribution. Because the money is deducted from your paycheck before taxes are calculated, you effectively reduce your taxable income. This translates to lower tax liability compared to paying for these expenses out-of-pocket with after-tax dollars. The amount you save depends on your tax bracket; higher tax brackets see greater savings. Remember, however, that unused funds in your FSA at the end of the year are typically forfeited. Consult your employer’s plan documents and the IRS guidelines for complete details on eligibility and tax implications.

Types of FSAs⁚ Health, Limited Purpose, Dependent Care

The most common type is the Health FSA, covering various medical expenses not covered by insurance. This includes deductibles, co-pays, and some over-the-counter medications (rules vary). A Limited Purpose FSA (LP-FSA) is more restrictive, typically only covering vision and/or dental expenses. This is often offered alongside a Health Savings Account (HSA) to avoid overlapping coverage. Lastly, a Dependent Care FSA (DC-FSA) helps with childcare costs to allow the employee to work. Eligible expenses often include daycare, preschool, before/after school care, and even summer camp (again, specific rules apply). The type of FSA offered, and the specific expenses covered, are determined by your employer’s plan. It’s crucial to review your employer’s plan documents to understand which type of FSA you have and what is covered under your specific plan.

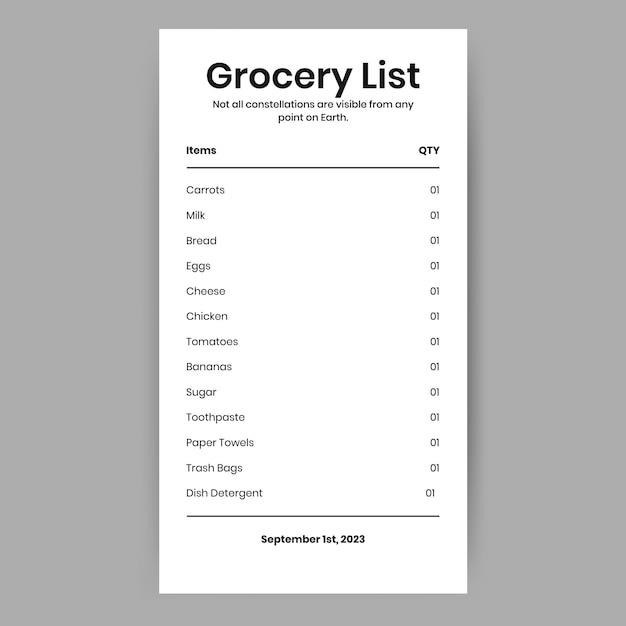

FSA Eligible Expenses⁚ A Comprehensive Guide

This section details common FSA-eligible expenses, clarifying what qualifies for tax-free reimbursement. Remember, specific rules vary; always check your plan documents.

Eligible Medical Expenses⁚ A General Overview

The IRS broadly defines eligible medical expenses as those paid for the diagnosis, cure, mitigation, treatment, or prevention of disease, or to affect body structure or function. This includes doctor visits, hospital stays, surgeries, and prescription medications. Many over-the-counter (OTC) medications are now also eligible, a recent significant change. Dental and vision care are often included, though specific coverage can vary by plan. Always check your specific FSA plan documents for a complete list of covered expenses and any limitations.

Remember that even if an expense appears on a general list of eligible items, your individual plan may have additional restrictions or requirements. It’s crucial to verify coverage with your FSA administrator before incurring expenses, to avoid potential issues with reimbursement.

Over-the-Counter (OTC) Medications and Menstrual Products

A significant update to FSA eligibility rules now includes many over-the-counter (OTC) medications. Previously requiring a prescription or letter of medical necessity, many common pain relievers, allergy medications, and other OTC drugs are now reimbursable without additional documentation. However, specific products and limits may still apply depending on your plan. Always refer to your plan’s detailed list of eligible OTC medications.

Another important change is the inclusion of menstrual products as eligible expenses. This means that tampons, pads, and other menstrual hygiene products can now be purchased using your FSA funds. This expansion of eligible items reflects a growing focus on inclusivity and access to essential healthcare products. Check your plan documents to confirm specific product coverage under this category.

Prescription Drugs and Medical Devices

Prescription medications are generally eligible expenses under most FSA plans. This includes both brand-name and generic drugs, provided they are prescribed by a licensed medical professional for a legitimate medical condition. However, some plans may impose limits on the quantity or type of medication that can be reimbursed. Always confirm your plan’s specific rules regarding prescription drug coverage. It’s crucial to retain all receipts and prescriptions to support your claims.

Many medical devices are also eligible for FSA reimbursement. Examples include insulin pumps, blood glucose monitors, CPAP machines, and other devices used to manage chronic health conditions. The eligibility of specific devices can vary depending on the plan, so it is always recommended to check your plan’s documentation or contact your administrator for clarification before purchasing any medical device. Remember to keep documentation of purchases and prescriptions.

Vision and Dental Care

Many vision and dental care expenses are commonly covered under FSAs, although specific coverage can vary significantly depending on the individual plan. Routine eye exams, prescription eyeglasses, contact lenses, and even some vision therapy may be reimbursable. However, elective procedures like cosmetic enhancements are typically excluded. Always verify your plan’s specific allowance for vision care expenses, paying close attention to any limitations on reimbursements for frames or lenses. Keep detailed records of all expenses for easier claim processing.

Similarly, dental care expenses often fall under FSA coverage. This can include cleanings, fillings, extractions, and orthodontics, but again, this depends entirely on the specific plan. Cosmetic dental procedures are usually not covered. Before incurring dental expenses, it is best to review your plan’s details to determine which services are eligible for reimbursement under your FSA plan. Document all expenses, including receipts and any relevant paperwork from your dental provider, to support your claims.

Finding FSA Eligible Item Lists

Several resources provide comprehensive lists of FSA-eligible expenses. Check your employer’s plan documents, consult the IRS website for official guidelines, or utilize third-party FSA resources and store websites.

Accessing Official IRS Guidelines

The Internal Revenue Service (IRS) provides the ultimate authority on what constitutes an eligible expense for Flexible Spending Accounts (FSAs). Their publications, particularly Publication 502 (Medical and Dental Expenses), offer detailed guidance. While not an exhaustive list of every single item, Publication 502 thoroughly explains the criteria for determining eligibility. It clarifies the definition of qualified medical expenses, encompassing diagnosis, cure, mitigation, treatment, or prevention of disease, and affecting the body’s structure or function. Understanding these guidelines is crucial for ensuring your FSA reimbursements are compliant. The IRS website is the best place to find the most up-to-date version of Publication 502 and other relevant tax documents. Remember that interpretations of these guidelines can be complex, and specific situations may require professional tax advice. Always double-check with your FSA administrator for clarification on specific expenses before making a purchase.

Employer-Provided FSA Information

Your employer plays a vital role in defining the specifics of your FSA plan. While the IRS sets broad guidelines, your employer’s plan dictates which expenses are reimbursable within its framework. This information is typically provided in your employee benefits handbook or on your company’s internal benefits portal. Look for documents outlining eligible expenses, often presented as a detailed list or a summary of categories. Some employers may offer a downloadable PDF detailing eligible items, offering a convenient reference. Contact your Human Resources department or benefits administrator if you can’t find this information readily available. They can provide clarification on specific items or offer additional resources. Remember that employer-provided lists are not universally applicable; they are specific to your company’s FSA plan, and discrepancies may exist between your company’s plan and other plans. Always consult your employer’s materials for definitive guidance.

Third-Party Resources and FSA Stores

Beyond employer-provided resources, numerous third-party websites and FSA-focused stores offer comprehensive lists of eligible items. These resources often compile information from various sources, including the IRS guidelines, to create extensive, searchable databases. Many FSA stores provide detailed product catalogs, often with filters to easily identify FSA-eligible products. These online platforms can be invaluable when you’re unsure if a particular item is covered. However, remember that these third-party lists are for informational purposes; Always verify eligibility with your employer’s plan documents before purchasing an item. Discrepancies may exist between a third-party list and your specific FSA plan. While these resources can be extremely helpful, they should not replace direct verification with your plan administrator or your company’s benefit documentation. Remember that final determination of eligibility rests with your employer’s FSA plan.

Important Considerations and Limitations

Annual contribution limits exist, and unused funds typically forfeit at year’s end. Eligibility rules change; always check the latest IRS guidelines and your employer’s plan details.

Limitations on Reimbursement

FSAs often impose limits on the total amount you can contribute annually. These limits are set by the IRS and can vary from year to year. Additionally, your employer may set their own lower contribution limits for their FSA plan. Keep in mind that you won’t be able to claim reimbursement for expenses exceeding your annual contribution limit. Even if you have funds available in your FSA, there might be restrictions on how much you can claim per expense or per year for specific items. Some plans may require receipts or other documentation for reimbursement. Furthermore, not all medical expenses are eligible for reimbursement, even if they are considered medical expenses by the IRS. The specifics depend on your employer’s plan and the IRS guidelines. Always check both for clarity. Failure to adhere to these limitations may result in the denial of your reimbursement request. It is crucial to understand these rules before making any purchases or seeking reimbursement to avoid disappointment. Review your plan documents carefully to understand the specific limitations and requirements.

Changes to Eligible Expenses Over Time

The list of FSA-eligible expenses isn’t static; it evolves due to updated IRS guidelines, revenue rulings, and court cases. What’s eligible one year might not be the next. For example, over-the-counter medications and menstrual products recently became reimbursable under many FSA plans, highlighting this dynamism. Staying informed about these changes is crucial to maximize your FSA benefits. Regularly check your employer’s FSA plan documents and the official IRS website for updates. These resources provide the most accurate and up-to-date information on eligible expenses. Third-party websites offering FSA information can be helpful but should always be cross-referenced with official sources. Paying close attention to these updates ensures you are using your FSA funds effectively and avoiding ineligible purchases. Ignoring these changes might lead to disallowed reimbursements and wasted funds. Proactive monitoring is essential for successful FSA utilization.